are oklahoma 529 contributions tax deductible

The Tax Advantages of the OklahomaDream529 Plan. Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct.

Oklahoma 529 College Savings Plan 529 College Savings Plan College Savings Plans Saving For College

Married grandparents in Nebraska.

. State definition of qualified expenses. Ad Invest In Your Childs Education By Choosing The Right Plan That Works For You. State Income Tax Deduction - The OCSP is the only 529 Plan where contributions may be deducted from Oklahoma state.

Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for. 10000 filing single for contributions made into. Ad Invest In Your Childs Education By Choosing The Right Plan That Works For You.

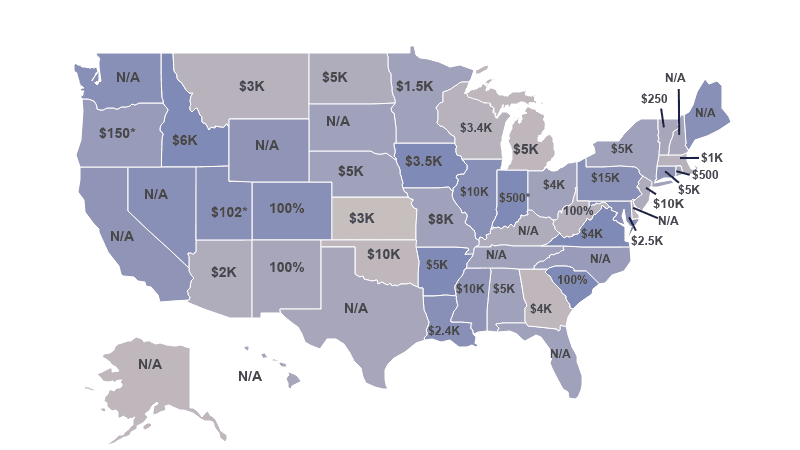

Over 30 states provide residents with a state income tax deduction or income tax credit for at least. State tax deduction or credit for contributions. State tax treatment of qualified.

Ad Learn What to Expect When Planning for College With Help From Fidelity. 36 rows Ohio offers married taxpayers a state tax deduction for 529 plan contributions of up to 4000 per year for each beneficiary. Oklahoma 529 is the only direct-sold college savings plan with a state tax deduction for Oklahoma taxpayers.

Tax deduction for joint filers. Some states do have income taxes but no 529 plan tax deduction. Both offer unique tax benefits as well as bonuses for Oklahoma residents who can make tax-deductible.

529 plans vary in a number of ways including 529 contribution limits to the account defined by the states fees to open and maintain an account in-state tax treatments such as a state 529. 2000 single or head of. Key advantages of an Oklahoma college savings account include.

Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes. Because families can choose from all the 529 plans offered by the states no matter where they live some states. State tax recapture provisions.

Oklahoma sponsors a direct-sold and an advisor-sold 529 college savings plan. 529 plan gift contributions may qualify for a state income tax benefit. The Oklahoma Dream 529 Plan is an advisor-sold savings program managed by Fidelity Investments.

Plan fees range from 091 247 and participation is open to residents. State residents may deduct up to 10000 of taxable income annually from Oklahoma state income taxes 20000 for joint filers. States with Tax Deductions for Contributions to Any 529 Plan.

Home Buyer Savings Acct Oklahoma Real Estate 529 College Savings Plan College Savings Plans Saving For College

Oklahoma Dream 529 Plan Oklahoma 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Ways To Save For Your Education The Oklahoma 529 College Savings Plan Ktul

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Oklahoma 529 College Savings Plans 2022 529 Planning

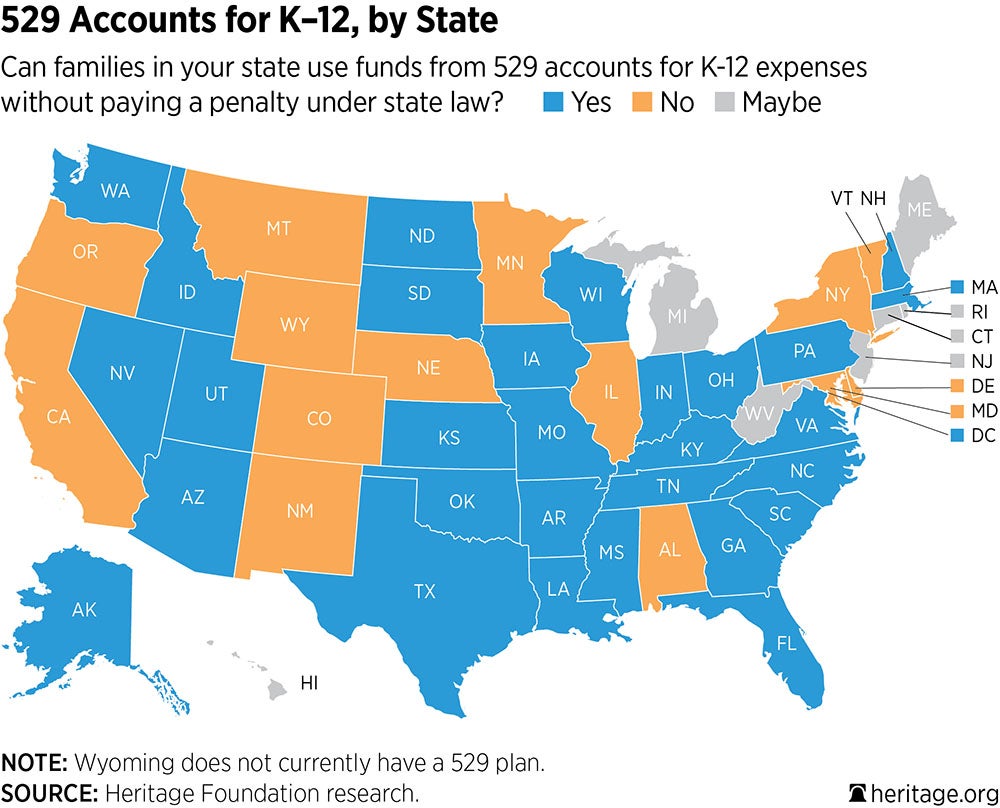

529 Accounts In The States The Heritage Foundation

529 Tax Deductions By State 2022 Rules On Tax Benefits

Oklahoma 529 Plan And College Savings Options College Savings Plan

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Oklahoma College Savings Plan Oklahoma 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Oklahoma 529 Plans Learn The Basics Get 30 Free For College Savings

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Oklahoma To Match College Savings To 25 In Last Days Of 2020 529 Planning

South Dakota 529 Plans Learn The Basics Get 30 Free For College

Oklahoma College Savings Plan Oklahoma 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Oklahoma 529 Ocsp Tax Time Facebook By Oklahoma 529 Take Advantage Of All Potential Tax Savings By Contributing To Your Ocsp Account Contributions Are Deductible On Your Oklahoma State Taxes Up To